Metrus enables customers to implement energy efficiency projects and improvements at scale through an innovative, off-balance-sheet financing model that does not impact the customer’s debt capacity or compete with other CapEx demands. Through our model, we fund all development costs and guarantee that customers remain cash-flow positive for the duration of the contract. As a result, Metrus has become a popular financing partner for commercial, industrial, and institutional customers seeking to decarbonize their facilities, improve sustain-ability, increase operational resilience, and reduce their energy—with no upfront cost.

Sustainable Energy Services Agreement (SESA)

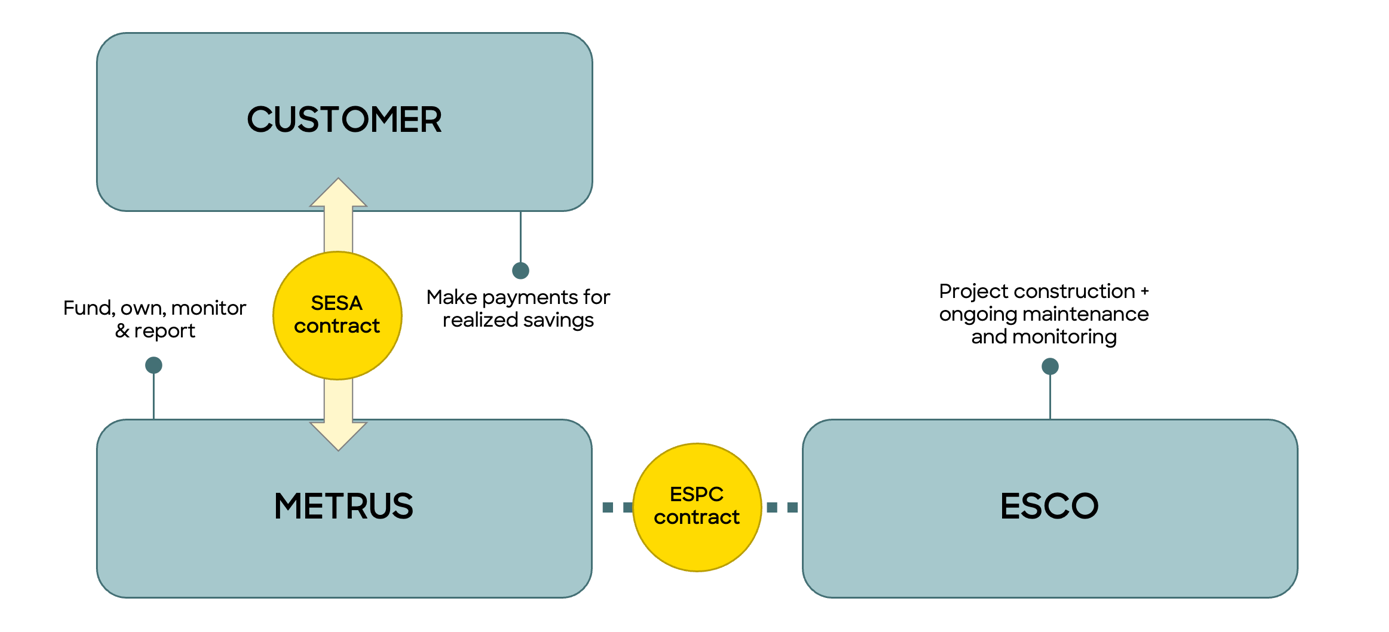

Metrus’ Sustainable Energy Services Agreement (SESA) is our proprietary financing model that bundles together all the equipment, technologies, maintenance, and monitoring into one flexible contract. From determining which upgrades will best meet the customer’s goals to en-suring that the upgrades deliver the promised savings, the Metrus SESA is an end-to-end so-lution that allows the customer to enjoy all the benefits of an energy retrofit with no capital outlay.

How the Metrus SESA works

- Metrus conducts a series of energy audits in order to define the precise scope and ex-pected savings of the project. The audit process enables Metrus to identify the up-grades that will yield the energy savings required to fund the project without impacting the customer’s bottom line. Metrus then enters into a Sustainable Energy Services Agreement with the customer that details the implementation of the project and its op-erational and financial framework.

- Metrus works with a third-party energy services contractor (ESCO) to engineer, imple-ment and maintain the energy efficiency project. This is done through an Energy Sav-ings Performance Contract (ESPC), also known as an Energy Performance Contract.

- Metrus retains ownership of all project-related assets for the duration of the ESA term and pays for associated maintenance services to ensure long-term reliability and op-timal performance of the systems.

- In each billing period, the performance of the project is quantified using agreed-upon measurement and verification (M&V) protocols, compliant with International Perfor-mance Measurement and Verification Protocol (IPMVP) established by the U.S. De-partment of Energy. These verified savings provide the basis for the SESA service charge.

- After the SESA term expires, the customer has the option to purchase the equipment at fair market value.

SESA structure: Designed for optimal outcomes

The SESA is a traditional project finance structure with clear roles and responsibilities between stakeholders

Benefits of financing energy efficiency through a Metrus SESA

By leveraging the savings that upgrading inefficient equipment will yield, the Metrus SESA delivers a range of benefits to customers. These include:

- Avoided capital outlay: Metrus pays for all project design and implementation costs, enabling customers to conserve scarce capital funds for investment in their core busi-ness.

- Reduced operating costs: SESA payments are set below the current utility price; the project is cash-flow positive from day one.

- Enhanced reliability of operations: Metrus pays for periodic maintenance services to ensure long-term reliability and performance of the project equipment.

- Cleaner, more comfortable indoor environment: In addition to reducing energy con-sumption, upgraded equipment and advanced building controls create a more healthy and comfortable indoor building environment.

- SESA payments treated as an operating expense: The SESA is a services agree-ment with regular payments that are treated as an operating expense (similar to a utili-ty bill or PPA).

- Reduced exposure to utility price uncertainty: SESA payments escalate at a pre-negotiated, fixed annual rate that is set below historical annual utility price increases.

- No performance risk: Metrus assumes responsibility for achieving the energy sav-ings guaranteed under the Sustainable Energy Services Agreement.

- Flexible and scalable financing: Under Metrus’ SESA, new opportunities for savings are identified and funded as they emerge, and rolled out to additional buildings across facilities.

Frequently asked questions

How is the SESA off balance sheet?

The SESA is a service agreement for the delivery of energy savings/generation, not a lease. It is a qualified off-balance sheet accounting treatment under FASB ASC 842.

How are SESA payments set?

SESA services charges are set as a cost per unit of energy saved utilizing an SESA rate (e.g., $/kWh). Service charges are set at or below a customer’s existing utility rates, resulting in re-duced operating expenses for customers.

What happens at the end of the SESA term?

At the end of the SESA term, the customer has the option to renew the agreement or pur-chase the equipment for its fair market value.

Do SESA rates fluctuate with my utility rates?

No. SESA service charges are set at contract signing and then escalate each year at an agreed upon escalation rate (similar to a solar PPA). The SESA escalation rate remains the same whether actual utility rates increase or decrease over time.

Getting started with energy efficiency financing

Contact Metrus today to find out if the Metrus SESA is the right energy efficiency financing solution for you. Metrus offers a free remote energy audit that is a helpful first step in determining the feasibility, optimal scope, and savings potential of your energy efficiency project.